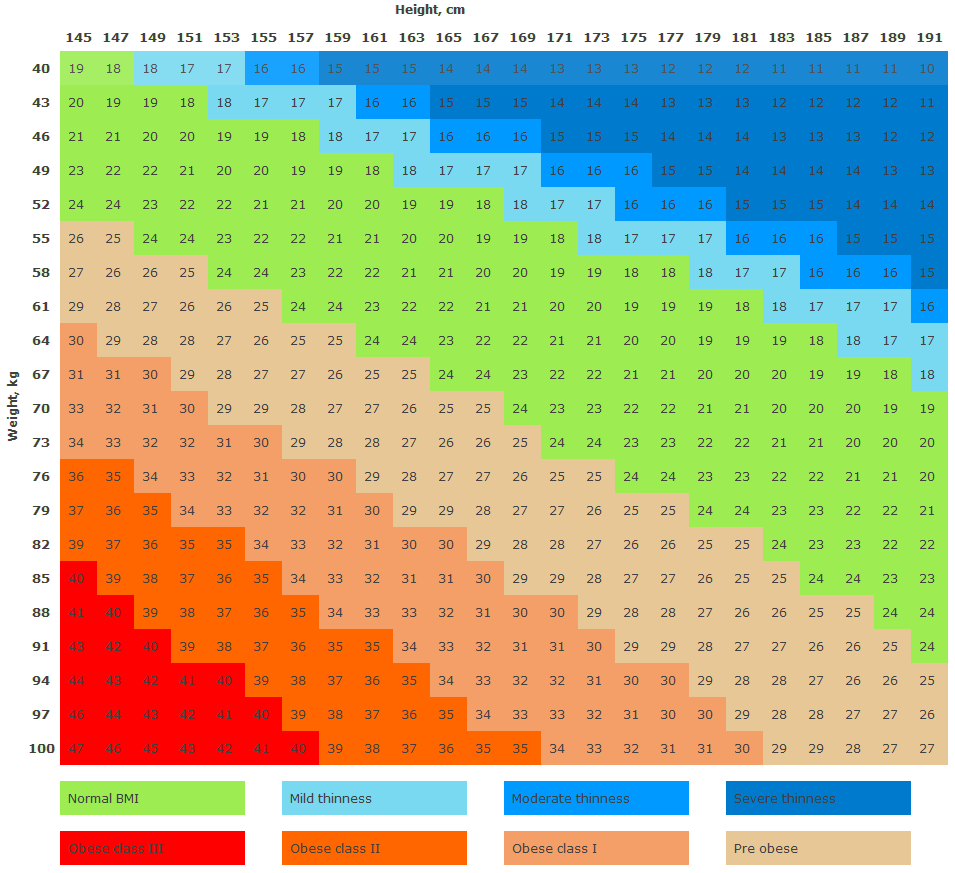

The lifetime discount of 7.5 per cent on annual premiums for new lump sum covers will apply to customers with a BMI between 18.5 and 28.5 and to products regarding Life Cover, TPD and Critical Illness.

“Our data shows by attracting healthier customers who are less likely to claim, we can help keep premiums more affordable and stable in the long term.”

“While BMI does not provide a complete picture of a person’s health, there is evidence that a healthy BMI is associated with a reduced risk of a range of conditions, including heart disease, cancer and diabetes.

And using BMI as a metric is easy to calculate and verify.”

This comes after the COVID-19 pandemic affected customers’ health, with 35 per cent of Australians gaining weight according to an Ipsos global survey conducted in 2021.

This was likely to increase the number of life insurance claims lodged in the future.

After 37 years in advising we know that life insurances have downsides when there is a waiting period to claim, its very dear even after 50+ when you are most likely to need it & for this boomer it has expired.

Hence you need an optimal option I call 'wellness insurance' which has allowed me to run home when the car is being serviced today.

It makes cents to be weller for longer

PM today to have your BMI within limits tomorrow

Are you one of the 35%??