About John

Discover how I after 37 years as a retired financial adviser I am too aware 76% of retirees collect some pension & in their later years spend too money & time under some form of care. ie a loss of self reliance & self respect. It makes cents & saves $$$ to be weller for longer

What is the problem?

It is a sad fact that new research shows most Australian seniors are living in fear that they will outlive their savings.

Your are very aware that your own income protection is very dear if you still have it & waiting periods dont cover the flu & 'new policies are junk" and your family's health insurance is necessary but who wants to collect it.

You are aware that you don't want to spend 10,000 p.a. on health costs for your next chapter of life.

What is the Solution?

How do we do that?

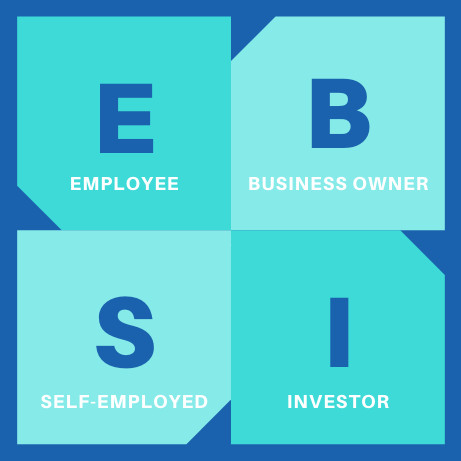

Cashflow Quadrant Guide To Financial Freedom

The letters in each quadrant represent the Employee, Self-Employed, Business Owner, and Investor. Discover how to move from the left side to the B and I Quadrants, where you work less, earn more, pay less tax and have more free time to spend with your loved ones!

Request a free eBook to learn more

Your heath is in Danger

Yes, our health is in danger. I realize this is a shocking statement, but after you're finished reading, you'll understand why I chose it. In the next few pages, I'd like to share with you some startling research from the cutting edge of health and science. I'll also be sharing some little known health secrets. This valuable information just might add several years of healthy living to your life.

Request a free eBook to learn more

John Michael McAuliffe AFA, DipFp., BSc., DipTeach.